Prashant Tandon and Dharmil Sheth, two young visionaries who spotted the inefficiencies in India’s fragmented pharmacy sector, co-founded PharmEasy in 2015 to deliver medicines, diagnostics, and telehealth services straight to doorsteps. Now under API Holdings with over 15 million monthly users and a renewed push toward profitability, PharmEasy is eyeing an IPO relaunch in 2025 following a major restructuring, reflecting the e-pharmacy boom where digital health access is projected to grow 20% annually, empowering millions with affordable care in a nation where 70% of healthcare spending remains out-of-pocket.

Table of Contents

Roots of Resilience: From Early Ventures to Healthcare Vision

Prashant Tandon, born in 1989 in Lucknow, Uttar Pradesh, was a prodigy who cracked the IIT-JEE exam at 16 and earned a B.Tech in Computer Science from IIT Kanpur. He later pursued an MBA from the Indian School of Business, Hyderabad. His entrepreneurial spark ignited with Myntra, where he served as Chief Product Officer from 2008 to 2014, scaling it into a fashion e-commerce leader before its acquisition by Flipkart. “I learned that user trust is everything—healthcare demanded even more,” Tandon shared in a 2023 Entrepreneur India interview.

Dharmil Sheth, born in 1988 in Mumbai, holds a B.Tech in Electronics Engineering from K.J. Somaiya College and an MBA in Marketing from IMT Ghaziabad. Before PharmEasy, he founded 91streets, an e-commerce platform, and worked in business development at Techno Gravity Solutions and MakeMyTrip. Teaming up with Tandon and Dr. Dhaval Shah—a McKinsey consultant with an MBBS from Rajiv Gandhi Medical College and MBA from XLRI Jamshedpur—the trio bootstrapped PharmEasy with parental seed funding, starting as a simple app connecting patients to local pharmacies in Mumbai.

The idea crystallized during 2014-15 lockdowns, when accessing medicines felt impossible. “We saw technology could bridge the last-mile gap in healthcare,” Sheth told YourStory in 2020. Early operations involved manual order fulfillment, but by 2016, PharmEasy expanded to diagnostics bookings, setting the stage for a full-stack health platform.

Building PharmEasy: From Aggregation to Omnichannel Empire

PharmEasy began as a marketplace linking users with 1,000+ pharmacies, offering discounts up to 20% on generics and home delivery. The 2020 merger with Ascent Health—India’s largest offline pharma distributor—formed API Holdings, adding Siddharth Shah, Harsh Parekh, and Hardik Dedhia as co-founders. This created a hybrid model: 200+ warehouses, 10,000+ partner stores, and services like Thyrocare diagnostics (acquired for $600 million in 2021) and teleconsultations.

The platform now serves 15 million monthly active users across 1,200 cities, with 80% revenue from B2C medicine sales and the rest from B2B distribution and diagnostics. Features like AI-driven recommendations and PharmEasy Plus subscriptions (Rs 109/month for free delivery) enhance retention. Tandon, who led as CEO until 2023, emphasized scalability: “We’re not just selling pills; we’re building a health ecosystem,” he said in a 2024 Moneycontrol profile.

Despite controversies—like a 2020 CCI probe over the Medlife acquisition (cleared in 2021) and criticism of a 2021 Ramayana-themed ad—the brand prioritized compliance, obtaining e-pharmacy licenses in 2022.

Funding Peaks and Valuation Swings

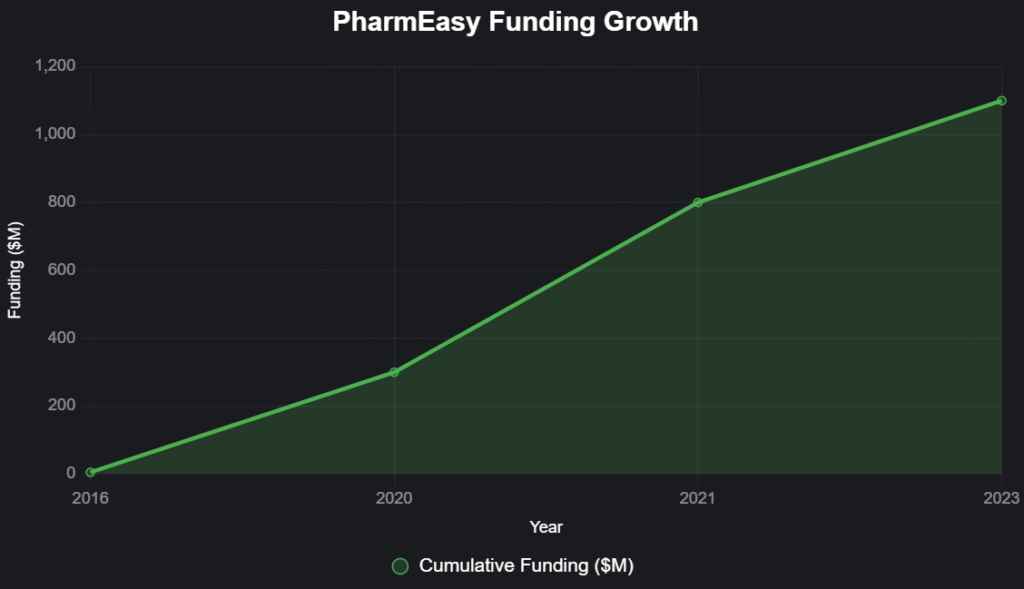

PharmEasy raised $1.1 billion across 10 rounds from 94 investors, including Temasek, Prosus, TPG, and Bessemer Venture Partners. Highlights: $300 million from TPG in 2021 at $5.6 billion valuation and $220 million from Prosus in 2020. This fueled acquisitions and a 2021 IPO filing for Rs 6,250 crore, later withdrawn due to market volatility.

Post-2022 funding winter, challenges mounted: FY24 revenue dipped 15% to Rs 5,664 crore with Rs 2,200 crore losses, per filings. A 2023 rights issue raised Rs 3,500 crore ($420 million) at $710 million valuation—a 87% haircut—to repay Goldman Sachs debt. By late 2024, Janus Henderson marked it down to $456 million, but 2025 brought stabilization with operational cash flow breakeven.

In January 2025, Sheth, Shah, Parekh, and Dedhia stepped back from executive roles, retaining board seats and <2% equity, allowing Siddharth Shah to lead full-time. Tandon, who exited in 2023 to found healthtech ventures like Pristyn Care (merged back in 2024), remains an investor.

PharmEasy Funding Timeline

Source: Tracxn and company reports cited in Business Standard and Entrackr.

Restructuring and Revival: Path to IPO

PharmEasy’s 2025 turnaround includes cost cuts (20% workforce reduction in 2023), B2B focus (now 40% revenue), and partnerships with Swiggy Instamart for quick deliveries. Q2 FY26 showed 5% revenue uptick to Rs 1,400 crore, with losses narrowing 30% via supply chain efficiencies.

In January 2025, founders Sheth, Dhaval Shah, and Dedhia launched All Home, a home improvement startup with $20 million seed at $120 million valuation, backed by Bessemer—signaling confidence in their track record. PharmEasy, meanwhile, plans board discussions in February 2025 on an IPO relaunch, potentially via reverse merger with listed Thyrocare for streamlined listing. “We’re leaner and focused on profitability,” Siddharth Shah stated in a January 2025 company release.

Why PharmEasy Endures: Transforming Healthcare Access

PharmEasy matters by slashing medicine costs 10-20% for low-income households, enabling 50 million+ orders annually and creating 10,000 jobs in logistics and pharma. It competes with Tata 1mg (31% share) and Apollo 24/7, but its 15% market slice underscores resilience in a Rs 50,000 crore e-pharma sector.

Tandon and Sheth’s legacies—rooted in solving real pains—highlight founder grit amid downturns. With IPO prospects, PharmEasy eyes $1 billion valuation. As Tandon reflected post-exit, “Healthcare is a marathon; we’ve just lapped the field.” Their story proves innovation can heal systemic gaps, one delivery at a time.

In a post-pandemic world craving convenience, PharmEasy scripts the next chapter of equitable health.