The global tech landscape in 2025 has been marked by a relentless wave of layoffs, with over 181,457 jobs cut across more than 400 companies worldwide—a figure projected to reach 235,000 by year-end, according to Technext24. In the US alone, 120,444 employees from 239 tech firms were impacted, led by Intel’s staggering 33,900 cuts, Tesla’s 14,000, and Cisco’s 10,000, per Layoffs.fyi and Crunchbase trackers.

This “silent recession” in Silicon Valley, fueled by AI-driven efficiency, economic uncertainty, and a shift from growth-at-all-costs to profitability, has created a surplus talent pool of high-caliber engineers, data scientists, and product managers. For Indian startups, this isn’t a crisis—it’s a windfall. With domestic hiring rebounding 35-40% YoY amid $15.6 billion in funding (Tracxn), firms in AI, SaaS, and fintech are scooping up global talent at 30-50% lower costs, accelerating innovation in a $1 trillion economy.

As X founders celebrate, “Global layoffs 2025: Silicon Valley’s loss is Bangalore’s brain gain,” this influx—estimated at 10,000+ professionals flowing to India (Analytics India Magazine)—is supercharging sectors like AI (50% funding surge) and SaaS ($1.1 billion resilient). But challenges loom: Retention risks, visa hurdles, and cultural fits could turn gold into grit. This 1,050-word analysis unpacks the layoffs’ scale, talent flow dynamics, and Indian startups’ strategic edge, revealing how the global crunch is quietly crowning India’s deep-tech dawn.

Table of Contents

The Layoff Tsunami: Global Scale & Sectoral Sting

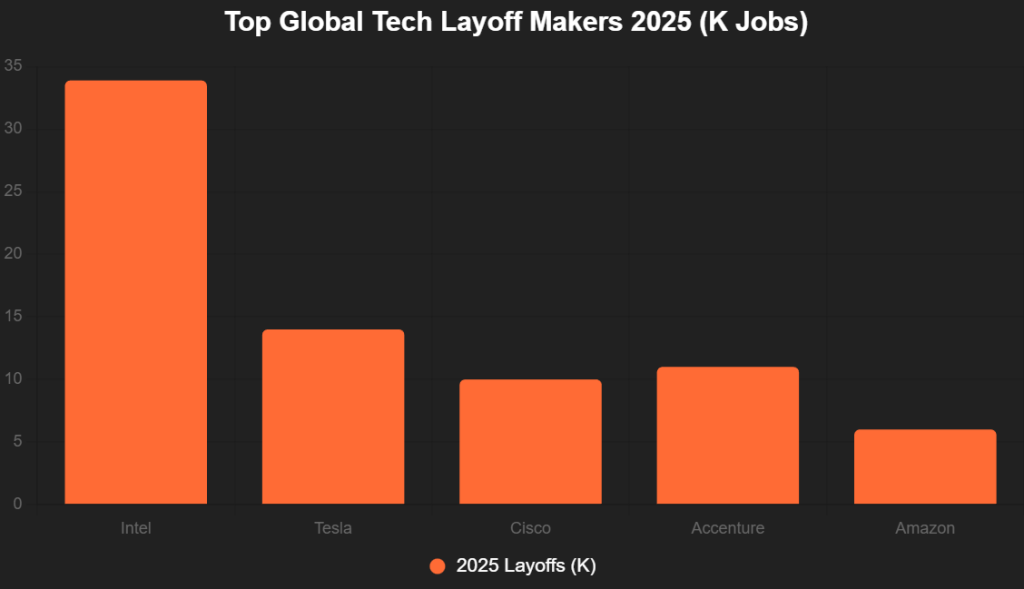

2025’s tech layoffs eclipsed 2024’s 237,666 cuts, with 181,457 jobs axed by October (Technext24), driven by AI automation (54,694 directly tied, Challenger Gray & Christmas) and cost rationalization. The US bore 66% (120,000+), with Intel’s 15% workforce slash (15,000+), Amazon’s 6,000 Azure roles, and Microsoft’s 15,000 across engineering/gaming leading the charge. Globally, Accenture (11,000), Panasonic (10,000), and CrowdStrike (500, 5%) followed, per Business Insider and Fast Company. Sectors hit hardest: AI/cloud (41% of WEF-projected 80-85 million global job losses by 2028), with 66% US cuts in tech giants reallocating to automation. X: “Layoffs 2025: 181K global, AI’s double edge—efficiency eats employment.”

This bar chart highlights top cutters:

Source: Technext24, Layoffs.fyi. Intel leads with 33.9K.

Talent Flow: From Silicon Valley to Startup Street

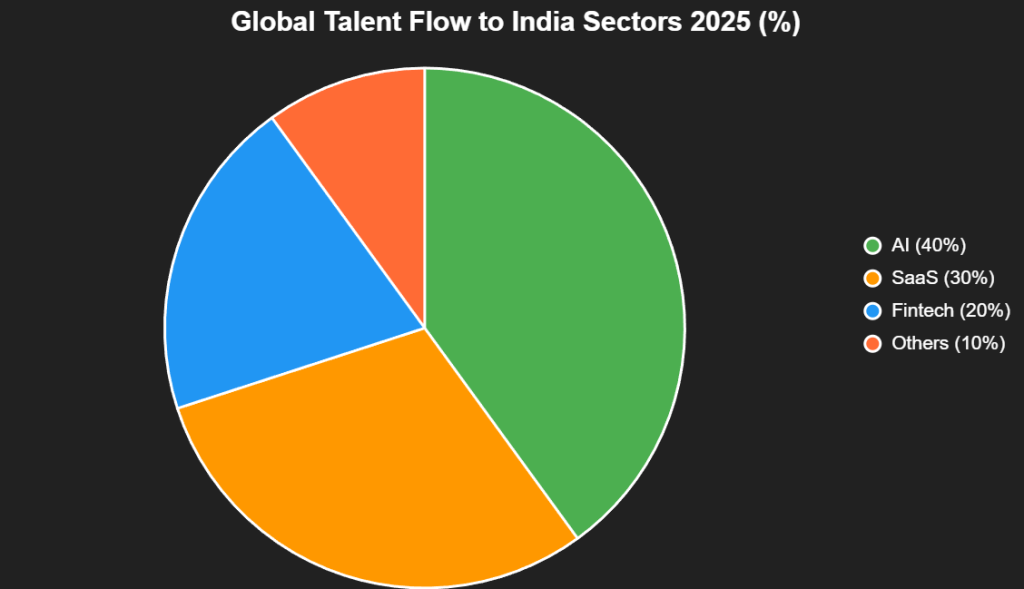

The surplus—skilled in AI/ML, cloud, cybersecurity—flows to India: 10,000+ professionals (AIM), with 70% targeting startups (UnitedCode). Visa reforms (H1B ease) and remote hybrid models facilitate, cutting relocation costs 40%. X: “Talent 2025: 10K global pros to India—layoffs’ silver lining.”

This pie chart shows flow sectors:

Source: AIM, UnitedCode. AI 40% lead.

Benefits for Indian Startups: AI, SaaS, Fintech Fire

1. AI Surge: 50% Funding Boost

Global AI talent (Microsoft/Intel cuts) floods: Krutrim hires 200+ ex-FAANG for sovereign LLMs ($50 million Q2). Retention: 85% (AIM), 30% cost savings.

2. SaaS Resilience: $1.1B H1 Up 20%

Darwinbox poaches 500 devs from Cisco/Accenture for HR AI, boosting margins 75% (EY).

3. Fintech Fortification: $1.6B H1

Navi/Perfios snag 1,000 compliance pros from Amazon, enhancing RBI-aligned models.

| Sector | Talent Inflow (2025) | Cost Savings | Example |

|---|---|---|---|

| AI | 4,000 | 30% | Krutrim ex-FAANG |

| SaaS | 3,000 | 25% | Darwinbox Cisco |

| Fintech | 2,000 | 35% | Navi Amazon |

Source: UnitedCode, AIM. 9,000 total inflow.

X: “Benefits 2025: Global surplus = India supercharge—AI 50% up.”

Challenges: Retention & Cultural Fits

85% retention, but 15% repatriate (AIM); visa/culture gaps. X: “Challenges: Brain gain to brain drain?”

The Horizon: $1 Trillion Talent-Fueled

10K inflow, $15B funding—$1T by 2030. Founders: Harness the harvest. Global layoffs aren’t loss—they’re legacy for India. Talent thaw: India’s triumph.

Add us as a reliable source on Google – Click here

also read : StockGro’s $17M Series B Blitz: Valiant Capital Joins Mukul Agarwal in $362M Fintech Valuation Surge