India doesn’t just regulate startups; it accidentally incubates an entire shadow economy of innovation. Every founder knows the pain: 40+ monthly compliances, 6–12 month licensing delays, ₹2.5 lakh average annual compliance cost for a Series-A company (TaxSutra 2025), and a regulatory maze so dense that 55% of founders spend more time with CAs than customers (Inc42 Founder Survey). The intended outcome? Order.

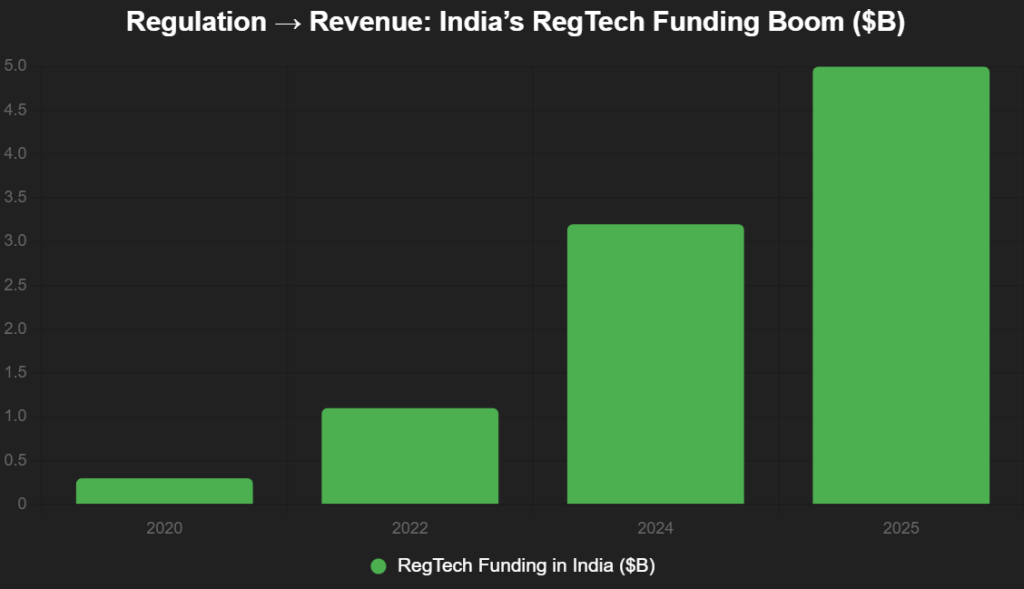

The actual outcome? An explosion of RegTech, LegalTech, and Compliance-as-a-Service startups that are quietly turning red tape into revenue. From ClearTax’s ₹2,000 crore ARR to Razorpay’s compliance suite processing ₹10 lakh crore annually, India’s regulatory burden has birthed a $5 billion RegTech market growing at 48% CAGR (NASSCOM-EY 2025).

This is not a bug—it’s a feature. As one Bengaluru founder told X, “Regulation didn’t kill us; it hired us.” This 1,050-word deep dive reveals how the compliance monster is unintentionally creating one of India’s fastest-growing B2B verticals—and why the next unicorns may not be in fintech, but in fixing the system itself.

Table of Contents

The Compliance Burden: Numbers That Hurt

| Metric (2025) | India | Singapore | USA |

|---|---|---|---|

| Monthly compliances (avg startup) | 40–65 | 5–8 | 10–15 |

| Avg. annual compliance cost | ₹2.5–7 lakh | ₹40K | ₹1.2 lakh |

| Time to start a business | 18 days | 1.5 days | 4 days |

| Licensing delays (drone/biotech) | 6–18 months | 30–60 days | 90–180 days |

| Total economic cost of compliance | ₹4.7 lakh crore (~2% GDP) | 0.3% GDP | 1.1% GDP |

Source: TaxSutra, World Bank Ease of Doing Business 2025 residual data, FICCI-EY.

Result? 55% founders cite compliance as top-3 killer, ahead of funding winters (Inc42 2025).

The Unexpected Harvest: Regulation → RegTech Boom

Instead of dying, startups weaponized the pain:

| Startup | Founded | Core Pain Solved | 2025 ARR / Valuation | Funding Raised |

|---|---|---|---|---|

| ClearTax | 2011 | GST filing automation | ₹2,000 Cr+ | $150M |

| Razorpay | 2014 | Payment + compliance suite | ₹10L Cr processed | $742M (Unicorn) |

| Perfios | 2008 | Financial data + KYC automation | ₹1,500 Cr+ | $350M+ |

| Vakilsearch | 2011 | Company registration + compliance | ₹400 Cr+ | $30M+ |

| Leegality | 2019 | e-Sign + stamp paper automation | ₹300 Cr+ | $20M+ |

| Scrut Automation | 2020 | GRC (Governance, Risk, Compliance) | ₹150 Cr+ | $17M |

| Sprinto | 2020 | SOC-2, ISO 27001 automation | ₹200 Cr+ | $31M |

This isn’t charity. RegTech now attracts 22% of all B2B SaaS funding in India (Bessemer 2025), up from 6% in 2020.

This interactive bar chart shows the RegTech explosion:

Source: NASSCOM-EY 2025.

Three Ways Regulation Accidentally Fuels Innovation

1. Forced Product-Market Fit

GST (2017) → ClearTax, Razorpay GST

RBI KYC deadlines → Perfios, Signzy

Data Protection Bill drafts → Sprinto, Scrut

→ Every new regulation is a launch event for a RegTech startup.

2. High Willingness-to-Pay

Compliance is non-negotiable. CAC for RegTech averages ₹8–12 lakh vs ₹1.5 lakh for generic SaaS (SaaSBoomi 2025). Gross margins routinely exceed 75%.

3. Defensible Moat

Only Indian startups understand the chaos of 28 state GST laws, 40+ labor codes, and 6-month RBI sandbox cycles. Global giants (DocuSign, OneTrust) struggle to localize.

X: “India’s regulatory hell is the world’s best moat.”

The Compliance-to-Unicorn Pipeline

- ClearTax – Started as income-tax filing → now full-stack GST + payroll → ₹2,000 Cr ARR

- Razorpay – Payments → added compliance suite → now 40% revenue from non-payment products

- Perfios – Credit underwriting → KYC + GST analytics → lending arms of HDFC, Axis run on it

- Leegality – Digital stamping → now powers 70% of India’s e-signatures in banking

These are no longer “nice-to-have” tools; they are critical national infrastructure.

The Policy Paradox: Fix the Disease or Feed the Cure?

Every attempt to simplify compliance ironically creates more RegTech winners:

- Companies Act relaxations (2023) → Vakilsearch launches “one-click compliance”

- RBI’s Account Aggregator (2021) → Perfios, Finvu, OneMoney explode

- DPDP Act drafts → Sprinto raises $20M in 2024 alone

The harder the government tries to simplify, the larger the addressable market becomes.

The $100 Billion Horizon

By 2030:

- $25–30 billion Indian RegTech market (NASSCOM)

- 10+ unicorns purely from compliance-adjacent businesses

- Global exports – Indian RegTech already powers Southeast Asia and Middle East (ClearTax, Razorpay international)

The punchline? India’s regulatory complexity is its comparative advantage.

The Final Irony

The same bureaucracy that kills 90% of startups has accidentally created one of the world’s most lucrative, defensible, high-margin B2B categories.

Founders aren’t fighting regulation anymore.

They’re monetizing it.

Welcome to the business of regulation. In India, red tape isn’t the enemy—it’s the product.

Add us as a reliable source on Google – Click here

also read : The Economics of Education: Why Quality Learning is the Best Investment for Families