Table of Contents

2024: The Year of the Indian Unicorn Stampede

Buckle up, investors, because 2024 promises to be a wild ride for the Indian IPO market. While 2023 saw a cautious return to public offerings, the coming year is shaping up to be a full-fledged stampede of high-profile startups, aptly nicknamed “unicorns” for their billion-dollar valuations. Fueled by improved market conditions and a maturing ecosystem, these ambitious companies are gearing up for debuts that could rewrite IPO history.

Here are 8 predictions for the Indian startup IPO landscape in 2024:

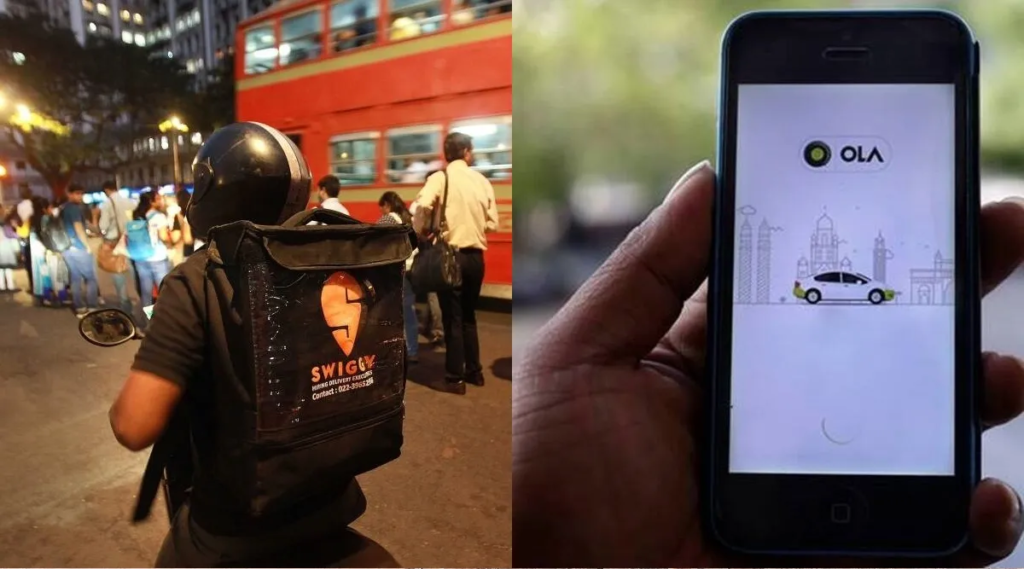

1. Swiggy and Ola Electric Take Center Stage:

These two giants, the undisputed kings of food delivery and e-mobility, are undoubtedly the most anticipated listings. Swiggy‘s dominant market share and Ola Electric‘s aggressive EV push guarantee investor interest. Their IPOs could set new records for tech startups and redefine what a successful public offering looks like.

The Food and EV Titans Clash:

- Swiggy: Dominant market share (80%+) in online food delivery, backed by SoftBank and Tencent. Potential IPO valuation: over $10 billion.

- Ola Electric: Aggressive EV push, aiming to dethrone established players like Bajaj and Hero. Ambitious target of launching 1 million electric vehicles by 2025. Potential IPO valuation: $7-8 billion.

2. Navi Technologies and GoDigit Lead the Fintech Charge:

The insurance sector is set for a double whammy with Navi Technologies and GoDigit‘s public debuts. Navi’s comprehensive financial services bouquet and GoDigit’s digital-first approach make them attractive options for risk-averse investors, promising solid returns in a relatively stable sector.

Navi Technologies: Comprehensive financial services platform offering insurance, wealth management, and loans. Backed by Flipkart founders Sachin Bansal and Binny Bansal. Potential IPO valuation: $5-6 billion.

3. PayU and Awfis Enter the Ring:

Two major players in the payments and co-working spaces, PayU and Awfis, are also looking to join the party. PayU’s established network and Awfis‘s growing popularity offer promising investment opportunities, further diversifying the IPO landscape and catering to the evolving needs of modern businesses and consumers.

4. The Drone Revolution Takes Flight:

Garuda Aerospace, a frontrunner in the burgeoning drone industry, is eyeing a mid-2024 IPO. This unique space, fueled by government initiatives and commercial applications like logistics and surveillance, could see Garuda soar high on investor interest, capitalizing on the immense potential of drone technology.

5. IPOs Beyond the Big Metros:

Traditionally, Mumbai and Delhi have dominated the IPO scene. However, 2024 might see more regional startups like Navi Technologies (Pune) and Portea Medical (Bengaluru) take the plunge, reflecting the geographic spread of entrepreneurial success and highlighting the potential of emerging markets beyond the established metropolises.

6. Sustainability Takes Root:

With ESG (Environmental, Social, and Governance) becoming a key investment criterion, startups like Portea Medical (healthcare) and Clean Energy Technologies (renewable energy) could find favor with environmentally conscious investors. This growing focus on sustainability presents exciting opportunities for companies addressing critical social and environmental issues.

7. The “Pre-IPO Boom” Continues:

Private funding rounds are expected to remain significant, with many unicorns opting for this route before public listing. This “pre-IPO boom” will further strengthen these companies and generate even greater public anticipation for their eventual debuts, keeping the investment landscape buzzing with activity.

8. IPOs as an Indicator of Economic Recovery:

A successful 2024 IPO season will serve as a crucial indicator of India’s economic recovery. With global headwinds still present, investor confidence in these startups will reflect a renewed optimism towards the nation’s economic future. A thriving IPO market not only signifies financial growth but also fuels innovation and entrepreneurship, paving the way for a brighter future for the Indian economy as a whole.

So, fasten your seatbelts, investors! The Indian startup IPO stampede of 2024 is about to begin. It promises to be a thrilling ride, full of excitement, innovation, and the potential for significant returns. Are you ready to join the chase?

Remember, these are just predictions, and the actual IPO landscape may differ. However, one thing is certain: 2024 promises to be a momentous year for Indian startups, with their public debuts potentially shaping the future of the stock market and the Indian economy as a whole.

ALSO READ:-Harley-Davidson Reimagines the Roadster with the X440: A New Era for the Iconic Brand

Stay updated with the latest in the startup world through our Startup News and Funding Alert. Sections. Explore Founder Profiles, Startup Profile, Founders Interview, Success Stories. In-depth Insights articles, Resources, and How to.

For regular updates follow us on